Xero

Streamline Accounting for Subscription Businesses

Maxio and Xero work together to automate the order-to-cash workflow for SaaS and subscription businesses.

Why Connect Xero and Maxio?

Connecting Xero and Maxio streamlines your business operations by automatically sharing data between the two systems. With this integration, you only need to enter your customer information, create invoices, and record payments in one place: Maxio.

All that financial data then seamlessly syncs over to your Xero account. This eliminates the hassle of manually transferring things like your customer contacts, invoices, payments, and credit memos between the two platforms.

This means no more double data entry or risking errors from copying information over — instead, Maxio becomes the centralized hub for all your billing and revenue activities, while Xero accurately maintains your books with that same financial transaction data.

How it works

Maxio is a financial operations platform for B2B SaaS companies that serves as a primary interface for managing contracts, transactions, invoices, and payments. This information can then be synced to Xero, keeping your accounting records up to date.

Even better, updates made in either system automatically update the other. This two-way sync gives you:

- A single view of your financials across platforms

- Automatic journal entries from Maxio transactions to Xero accounts

- The ability to email invoices directly from Maxio

With this information flowing between Xero and Maxio, you’ll gain a more holistic understanding of your company’s financial performance.

Product Details

The Xero integration is configured through Maxio’s settings panel.

Within the settings panel, you can choose how frequently you want data to sync between the two systems — nightly, every 4 hours, or even hourly. This automation ensures your records are always up-to-date.

Our Xero integration also lets you streamline your workflow in other ways, too:

- You can have Maxio automatically create product/service profiles, complete with details like revenue recognition schedules, when new items sync over from Xero. This saves you from having to configure those settings manually.

- Keeping customer addresses aligned is a snap too. Just map the address fields in Xero that you want to use for billing and shipping addresses in Maxio. No more inconsistent contact info!

- What about those generic invoice line items that don’t specify a product/service? No problem — you can assign a placeholder item in Maxio to handle those while still maintaining accurate invoice totals.

- You have full control over what data syncs as well. Date filters let you prevent historical records from crossing over, while also allowing you to backfill recent invoices or payments that didn’t initially sync.

- Lastly, you can even have Xero generate the invoice numbers to maintain your branded numbering system.

With options for automation frequencies, streamlined product setup, address mapping, placeholder items, date filters, and more, the Xero integration gives you both flexibility and consistency across both platforms.

Further Product Details

Maxio offers closing date, transaction lock date, and Xero lock date options to prevent changes to synced records. While the closing date finalizes Maxio records, the Xero lock date — which occurs on or after the Xero closing date — takes precedence. This ensures data integrity when statutory deadlines are in place for your linked Xero accounting period.

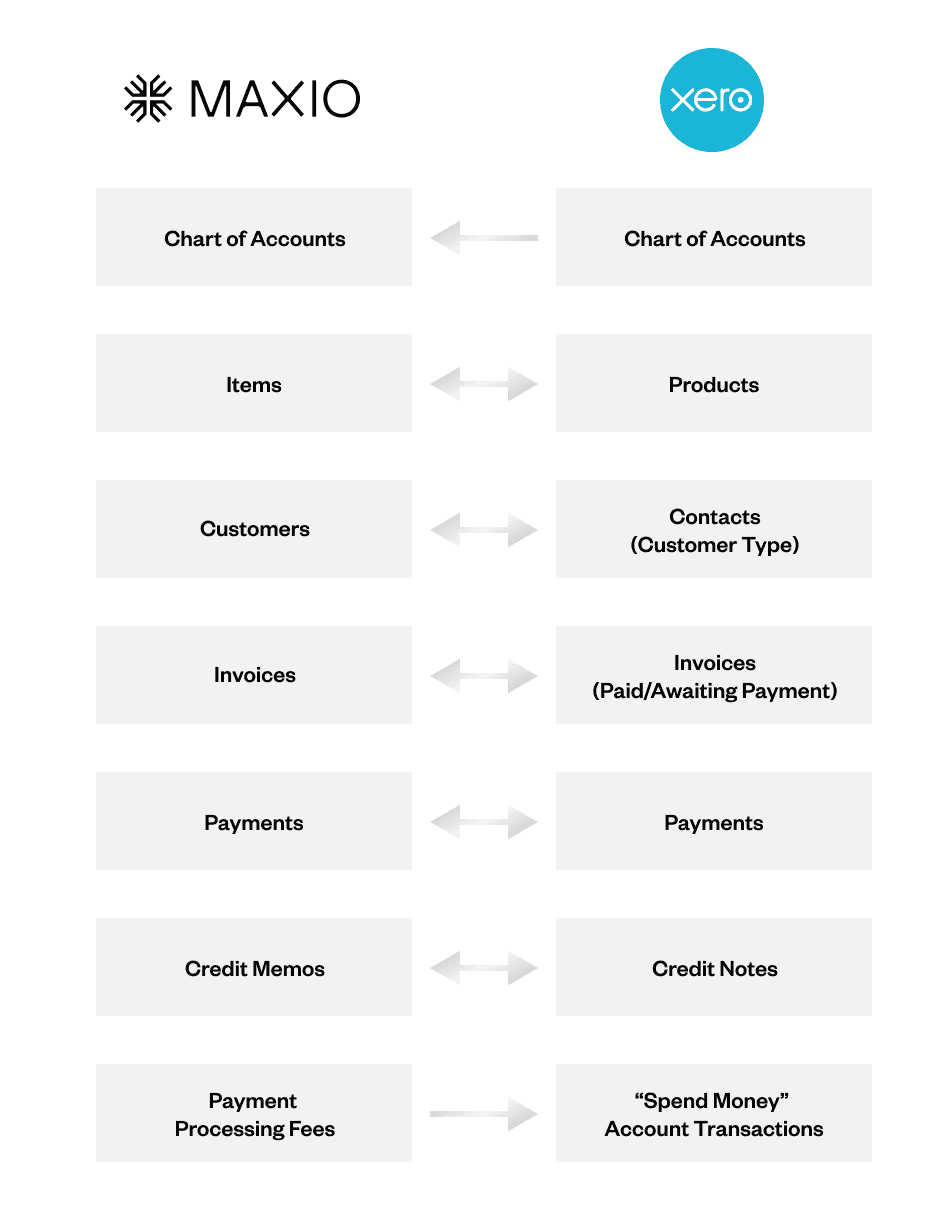

This integration maps Maxio revenue and liability accounts to the corresponding accounts in your Xero chart of accounts. This allows invoices, payments, and credit transactions to post to the proper income, expense, asset, and liability accounts for accurate financial reporting and reconciliation.

When you enable the “Auto Generate Profiles” option, any new items you create in Xero will automatically sync over to Maxio with important profile fields pre-populated based on the account type. And don’t worry, this auto-generation only applies to newly added Xero items. Any existing product/service profiles you already have in Maxio will be left untouched to avoid disrupting your current setup.

Customer records created or updated in Maxio automatically sync to the Contacts section in Xero. Key fields like names, addresses, and contact information remain aligned across both systems. This provides a centralized view of customer data.

Invoices generated in Maxio flow over to Xero in a two-way sync. Invoice details like dates, amounts, line items, and taxes are matched in both platforms. Any updates made to synced invoices in either system will be reflected in the other for consistent billing records.

Similar to invoices, payments received and recorded in Maxio are automatically logged in the Xero account register. This seamless sync ensures payment data is current in both systems for monitoring receivables without redundant data entry.

Credit memos issued against invoices in Maxio convert to credit note transactions in Xero. The original invoices are adjusted in both systems so financial records remain aligned with refunds or adjustments applied to customer accounts.

When payments are processed in Maxio, any third-party fees charged by the payment processor (e.g. credit card processing fees) are calculated. These fee amounts are then synced to Xero and recorded as account transactions coded to the appropriate fee expense account per your chart of accounts mapping.

Customers are matched using selected Xero address fields like postal data. Shipping addresses can also integrate through optional mapping. Consistent contact info enhances the customer experience.

The date filters give you control over what financial data syncs between Maxio and Xero. This prevents issues with historical records while allowing new transactions to flow seamlessly once you’re past a certain date.

Non-specific line items import with zero amounts as placeholders to maintain your invoice totals/balances for financial accuracy. This ensures all charges are represented without disrupting sync workflows.